DOT Increases Fines for Second Time This Year

Last week the FMCSA once again increased its baseline civil penalty amounts for federal trucking regulation violations. This is the second time this year that a Final Ruling was issued by the DOT announcing a fee increase. The new fines went into effect on May 3, 2021.

Of particular note, was the fee increase for fines related to DOT recordkeeping errors. The penalties for recordkeeping noncompliance have long been steep—and they’ve recently risen again. This makes it all the more important that you remain vigilant when it comes to your company’s recordkeeping.

New 2021 FMCSA Violation Fine Amounts

The new maximum penalty for non-recordkeeping violations is now $15,876 (compared with $15,691), while violations of Federal Motor Carrier Safety Regulations recordkeeping requirements is now $13,072 (up from $12,919). That same fine amount ($13,072) applies to knowing falsification of records.

Others include:

- Non-recordkeeping violations by drivers: $3,969

- Recordkeeping, maximum per day: $1,302

- Recording and recordkeeping under the interstate transportation code (minimum penalty): $1,125

- Recording and recordkeeping under the interstate transportation code (maximum penalty): $8,471

- Unauthorized disclosure of information: $3,389

Meanwhile, the maximum penalty for violations of hazardous materials transportation law is now $84,425, while the maximum penalty for violations of hazardous materials transportation law resulting in death, serious illness, severe injury, or substantial property destruction is $196,992.

You can view the full list of new fine amounts here.

What You Can Do

As we’ve just made clear, the penalties for not keeping accurate records, falsifying records, or not keeping records at all, can be stiff.

Added to this is the fact that offsite audits have increased by 400% over the last two years. And should an auditor come (virtually) calling, you now have 48 hours to submit all of your records—and in electronic form. This is compared with the several weeks’ time period of the past.

All this in mind, it has never been more important to have a fully compliant, well-organized recordkeeping system in place. And, just as critically, one that is digital—because this will help ensure that your records are accurate, secure, and free of common errors that occur with paper documents. It also simplifies the overall process, saves time, and perhaps most importantly, ensures that your company is always prepared for an offsite audit.

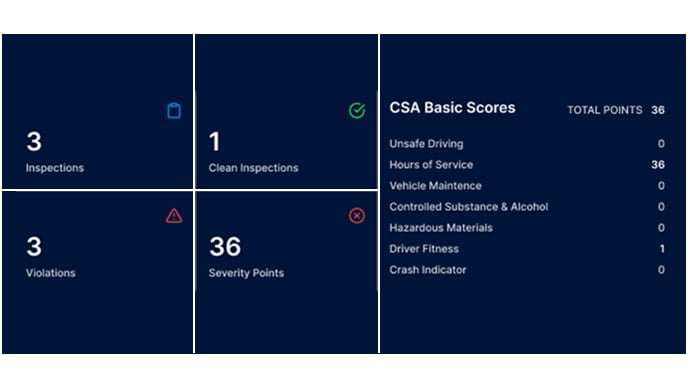

Foley’s compliance solution ensures that all of your compliance programs are in one place, digitally, with automatic updates and alerts. You’ll be able to stay on top of everything from driver qualification files, to drug and alcohol testing, to Clearinghouse updates.

Interested in learning how Foley can help your business get—and remain—compliant? Contact us today!

Related Articles

DOT Clearinghouse Fines Skyrocket in 2021

FMCSA Fines Have Increased For 2021

FMCSA Fines & Penalties Have Increased for 2025

.png)