Foley and Keystone Join Forces to Relieve Hard Commercial Insurance Market

HARTFORD & NORTHUMBERLAND, May 1 – Foley and Keystone have built a strategic partnership, combining Foley’s industry-leading driver data software and DOT compliance programs with Keystone’s unique commercial insurance and risk management solutions for US companies with transportation sectors.

With a 30 percent increase in commercial insurance premiums and underwriters requiring tangible proof of safety initiatives taken by companies with employees who drive, it can be challenging for these businesses to find affordable insurance coverage. While numerous factors out of their control (i.e. inflation), can impact their insurance costs, companies can control their risk profiles by implementing data monitoring programs that track driver safety behavior.

Joel Sitak, CEO of Foley Services, says this sort of hard data will benefit insurance agents who negotiate with underwriters on behalf of their clients. He explains, "The agent can really show the underwriter that their client is serious about reducing risk."

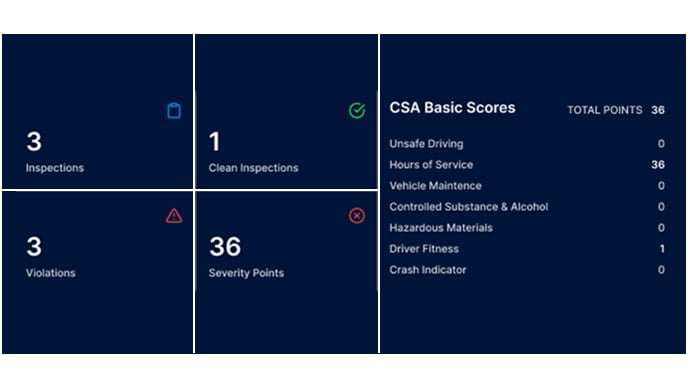

Sitak adds that it is critical to have access to this data the minute it registers with the FMCSA, which is how Foley's CSA Monitor works.

"It's getting access to that data faster so that you can take action on it before it becomes a problem in the underwriting process," Sitak says. "And by getting ahead of that, your underwriters are going to look favorably upon that situation."

As a result of this partnership, Foley and Keystone have cobranded a new white paper, Commercial Insurance Mayhem: How to Stop the Bleeding. It details the hard state of the commercial insurance market and how Foley’s Compliance, Safety, and Accountability (CSA) Monitor program helps Keystone customers achieve better CSA scores and lower insurance premiums.

Michael Kuiros, Director of DOT & Fleet Services and Risk Management for Keystone, says, "A lot of things are left out of your control. The things that are left in your control would be your CSA score."

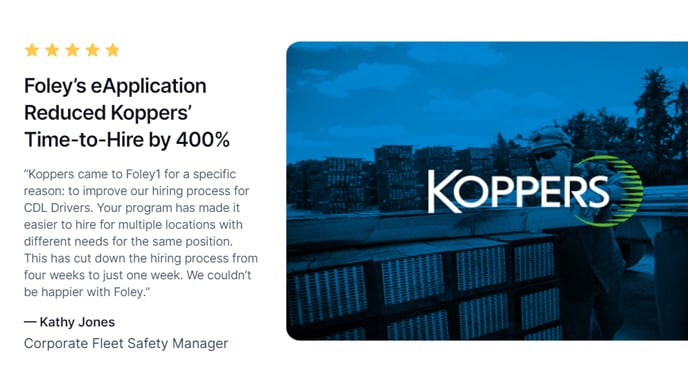

Partnering with Foley allows Keystone to provide their DOT-regulated clients with risk-reducing, and, over time, cost-saving software.

By connecting companies with risk mitigation solutions and agencies that highly regard them during the underwriting process, the Foley and Keystone collaboration helps soothe the financial insurance burden faced by owner-operators, large fleets, and other employers who rely on commercial drivers.

About Foley Services

For over three decades, Foley has been a trusted partner to companies with fleets of all sizes. Our technologically advanced approach to DOT compliance makes it easier for employers to track critical driver and business data to make informed decisions and proactively reduce risk.

About Keystone

Since 1983, Keystone has grown to partner with nearly 300 agencies to foster strong, reliable relationships between insurance carriers and customers. Individuals, families, and businesses gain access to industry expertise, financial services, and a network of quality independent agencies.

Contact:

Mariah Barr

mariah.barr@foleyservices.com

(716) 512-1706

Related Articles

Foley Launches New CSA Data Monitor Program

Why Driver Data is Key to Managing Fleet Risk

What the Hardening Commercial Insurance Market Means for Trucking Companies

.png)