How to Get Your Operating Authority

Obtaining your authority to operate can be a lengthy and complex process, but here's how to get your DOT operating authority quickly, compliantly, and affordably.

If you’re an owner-operator who is considering getting their own operating authority, you’ll need to be aware of the regulations and costs involved. Even though the financial risk is much lower when you're leased on with a carrier, the earning potential of operating independently convinces many drivers to do so every year.

Getting your authority to operate typically comes with a hefty price tag and a maze of federal regulations to navigate, but it doesn't have to be a stressful process.

Below, we answer the following questions to help you decide whether you should take the plunge and start your own trucking company:

- What is an operating authority?

- Do I need an operating authority?

- How do I get my own operating authority?

- What happens after I get my operating authority?

What is an operating authority?

If you're hoping to haul freight as your own trucking company, you'll need to obtain operating authority from the Federal Motor Carrier Safety Administration (FMCSA). This is done through an application process, and the FMCSA will issue a Motor Carrier (MC) number upon approval.

Do I need an operating authority?

For-hire, interstate carriers that haul federally regulated cargo or passengers need a motor carrier number.

Depending on what cargo you're hauling, you may need to apply for multiple types of operating authority. Additionally, some states may require Intrastate Authority if you're moving loads within their borders. It's essential to apply for the appropriate operating authority, as the entire process can take up to two months.

This chart from the FMCSA can help you decipher if you need an operating authority.

What's the difference between an operating authority and a motor carrier number?

An operating authority, or trucking authority, is your FMCSA-granted legal right to operate a commercial motor vehicle when working as a for-hire motor carrier in interstate commerce or hauling hazardous materials.

A motor carrier number, or MC number, is the unique identifier assigned by the FMCSA to commercial motor vehicles that transport interstate cargo once the authority to operate is given.

How do I get my own operating authority?

Before you get your authority to operate, you need to decide on the following business factors:

- Business name

- Business type — Foley highly recommends working with a trusted accountant to decide how your business should be organized: as a sole proprietorship, partnership, LLC, or corporation. Each type holds a different level of liability, and the taxes for each type vary based on the state you’re operating from.

- Freight — What products are you going to haul? Who are your future customers? Answering these two questions can help you decide what type of trucking business you want to run.

Proof of Insurance

Before the FMCSA approves your authority to operate, you’ll need to submit proof of liability insurance. You must have a minimum of $750,000 in liability insurance for general freight or $1 million for HAZMAT.

Insurance premiums could cost you anywhere from $4,000 to $16,000 per year per truck. The price depends on your driving record, the state you live in, and the states you plan to do business in. New carriers are often charged a higher premium, with the price typically dropping once the business is more firmly established.

Additional Operating Authority Requirements

You must also complete the following to get your authority to operate:

- BOC-3 Form — The FMCSA requires you to have a process agent in every state in which you do business. This is the person who would receive legal documents on your behalf in all 50 states and the District of Columbia.

- Heavy Highway Vehicle Use Tax (HVUT) – Any business operating commercial vehicles weighing at least 55,000 lbs has to pay the HVUT.

- Unified Carrier Registration (UCR) – You must file this registration with the state your business is based in, and the fee amount is determined by the number of trucks you operate.

- International Registration Plan (IRP) – Also known as your cab card, which is filed with your state.

- International Fuel Tax Agreement (IFTA) – A nominal setup fee, which is then based on your fuel use and operating state.

- Other state regulations — States such as New York, Kentucky, and New Mexico require weight distance permits when traveling through them.

- Drug and alcohol testing — You must enroll each of your drivers in a drug and alcohol testing program, and they all must pass a pre-employment drug test before getting behind the wheel.

Looking Ahead: The New Entrant Safety Audit

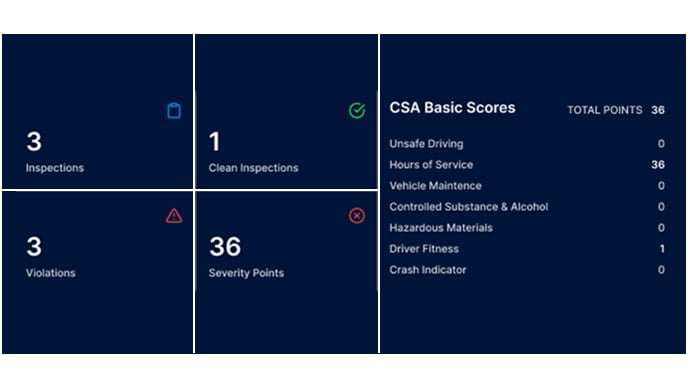

Once you clear all these hurdles, you’ll be enrolled in the DOT New Entrant Program. Within your first 18 months of business, you’ll receive a New Entrant Safety Audit that will assess your:

- Driver qualifications

- Driver logs

- Maintenance programs

- Accident register

- Driver qualification files

- Drug and alcohol policies

Get Your DOT Operating Authority with Foley

If you're starting a trucking company, you probably have a lot of questions beyond how to get your operating authority. Foley's DOT compliance experts can help those wondering how to get a DOT number, how to pass the new entrant safety audit, and more.

Simply fill out the short form below and one of our friendly specialists will contact you to create a custom DOT compliance and trucking business plan.

Related Articles

How to Become an Owner-Operator Truck Driver in 2025

How Much Does it Cost to Register a Commercial Motor Vehicle? Part 1.

Five Steps to Take Before Applying for a DOT Number

.png)