What the Hardening Commercial Insurance Market Means for Trucking Companies

Commercial truck insurance costs are rising. How can you save on your premiums while keeping the required coverage?

If you’ve renewed your truck insurance policy recently, you may have been hit with some sticker shock: as the insurance market hardens in 2025, premiums are rising rapidly.

“It’s a hardening market…carriers are coming to us as they are seeing a 25-30 percent increase in commercial insurance premiums across the board,” said Aaron Black, Director of Business Development for Keystone (formerly known as East Coast Risk Management).

What does this mean for trucking companies?

In addition to higher premiums, standards are also tightening, with underwriters scrutinizing carriers’ safety and compliance even more carefully. According to Black, “Underwriters are looking at risk much more closely than they did in the past.”

It’s not just individual carrier risk that is important, but the type of trucks they operate and the industry they’re in,” Black said. “Insurance is a business, and if they’ve found in the past that the payouts for certain vehicle types were too high, for example, they might decide to stop writing policies for those vehicles across the board.”

“This is why there aren’t a lot of options for towing or HAZMAT carriers right now. It’s a high risk that many insurance carriers don’t want to take.”

Shopping for Truck Insurance? Reducing Your Company's Risk Level is Key to Securing Affordable Coverage.

Although you can’t control the commercial trucking insurance market, something in your control can help you secure coverage and get the best possible rates: improving your risk profile.

With high-risk companies often paying $100-200K a year more than a policy purchased through the standard insurance market, you’ll want to consider the following steps (at a minimum) to ensure you’re in a good spot before shopping around for coverage.

#1: Track Your CSA Score

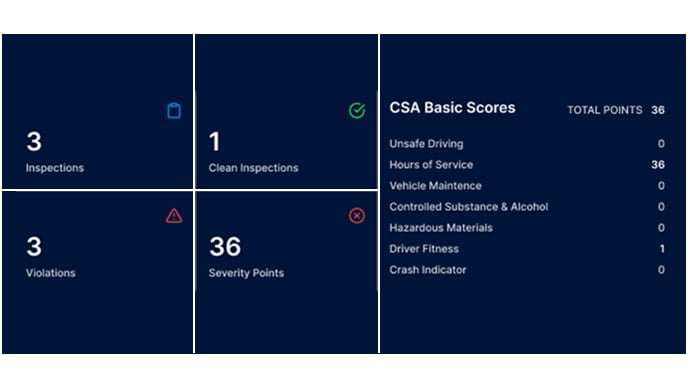

Your company’s Compliance, Safety, and Accountability (CSA) score can influence your insurance premiums — for better or for worse.

This score represents how well you've maintained roadway safety, compliance with DOT regulations, and avoiding crashes. Scores range from 0-100, with higher numbers showing an increased risk level due to accidents, DOT violations, failed roadside DOT inspections, or a combination of these factors.

You can learn more about CSA scores in this Foley article: CSA Scores: What They Are & Why They Matter.

Foley's Audit Risk Monitor (ARM) program provides monthly CSA score updates so you can see where your company's risk level stands. If you see any changes to your CSA score, you can react accordingly to fix the problem that's raising your safety and compliance risk (and, potentially, your insurance premiums).

#2: Audit Your Safety & DOT Compliance Programs

“A big part of what we do at East Coast Risk Management [Keystone] is performing mock audits for carriers to ensure they don’t have any compliance and safety gaps,” Black said. “If there are gaps — that’s where Foley steps in. Together, we can help ensure motor carriers are operating compliantly.”

No matter your company size or how long you've been in business, DOT compliance is complicated. But you don't have to try to meet all the DOT regulations on your own. Foley can help ensure you have compliant driver files, you're running the right FMCSA Clearinghouse queries, you're performing accurate DOT drug and alcohol tests on your drivers, and more.

#3: Evaluate Your Company's Loss History

Your total incurred claims shouldn’t be more than the amount you paid for coverage in any given year. PLUS, insurance companies also have to pay costs to underwrite, purchase reinsurance, and adjust claims on top of claim payments.

Remember: insurance companies are a business, and if they think they’re going to lose money on you, they’ll be less likely to provide you with a quote. Or, if they do quote, they will charge you far more than you would like to pay.

Simply put, insurance companies will charge you what they believe it will take to make money on you. Therefore, insurance companies usually price what they view as the best-performing companies at two times the expected or average annual claim costs. For those they believe to be poorer performing companies, the costs are often three to four times the expected or average claim costs.

#4: Establish a Risk Management Plan

Black recommends putting a risk management plan in place before shopping for insurance if a company’s CSA score is a concern. “Even if their scores aren’t great, if carriers can prove that they have a plan for improving their safety and compliance, and have shown they are serious about following through, it can drastically increase their odds of getting coverage.”

#5: Implement an MVR Monitoring Program

Insurance companies look at these programs very favorably because they help companies like yours effectively manage driver risk and often result in lower insurance premiums.

“Companies are required to pull an MVR annually as a best practice, but what about the other 364 days that drivers are out on the road?” Black said. “That provides a lot of opportunities for violations to occur that an employer may not be aware of.”

According to David R Leng, CPCU, CIC, CBWA, CWCA, CRM of the Duncan Insurance Group, “Risk Profile Improvement is a simple concept, but it is more complex to implement. As the expression goes, the devil is in the detail.”

“If you can get insurance companies to believe you can mitigate future claims, they will discount those claims that did occur in the past and provide you with lower rates than your claims’ data merits from a straight actuarial math standpoint,” he said. “You can influence the assumptions an underwriter uses to set up the actuarial math calculation of your premium.”

However, just having policies and procedures written down on paper is not enough. “Insurance companies live by the rule ‘Trust, But Verify’,” he said. “They will want to see proof of proactive programs, how they are managed, what decisions are being made, and what steps are taken when things pop up.”

For example, if your telematics shows a driver that repeatedly speeds excessively, or their monitored motor vehicle report has repeated significant speeding violations, and your files show no actions of discipline or termination of the driver, the insurance companies will not believe that you use any of the Risk Profile Improvement programs you say you have implemented.

“Unfortunately, insurance companies do not care that drivers are hard to find,” Leng said. “Insurance companies continually state that poor drivers and poor risk management processes lead to more claims, and they will act accordingly when it comes to quoting and pricing insurance policies.”

Foley's MVR monitoring program has been proven to reduce driver violations by up to 34 percent. Start investing in the safety of your drivers and get a free demo of our MVR check software.

Start Using DOT Compliance Software to Help You Save on Commercial Truck Insurance

History tells us that these challenging market conditions could stick around for a while, as the last few hard market periods lasted an average of three years. With that in mind, it’s essential to take whatever risk mitigation steps you can to improve your likelihood of securing insurance — and getting the best possible rate for your business.

If you're interested in learning more about the connection between DOT compliance software and lower insurance premiums, check out the Fixing Your Fleet with Foley Services episode on The Power Producers Podcast, where David Carothers interviews our CEO, Joel Sitak, and Head of Solutions Enablement, Scott Mogensen.

Foley's compliance experts also offer FREE DOT compliance software demos to help you take control of your truck insurance costs. Request your demo appointment by clicking here, or fill out the form below to get started.

Related Articles

Foley and Keystone Join Forces to Relieve Hard Commercial Insurance Market

Why Driver Data is Key to Managing Fleet Risk

Foley Launches New CSA Data Monitor Program

.png)