Why Driver Data is Key to Managing Fleet Risk

Implementing risk mitigation strategies is no longer optional for Fleet and Safety Managers.

It's a no-brainer that transportation fleets continue to play a crucial role in delivering essential goods and maintaining a strong supply chain in the US economy.

However, the list of risks associated with these fleets continues to grow. To address this, more companies with commercial drivers are turning to advanced safety technologies and risk mitigation programs that help with the three most common problem areas:

- Hiring safe, qualified drivers quickly and retaining them

- Reducing liabilities and insurance premiums

- Meeting FMCSA compliance requirements and passing audits

If your fleet is growing and continuing to operate in 2024, you're likely facing one or more of these pain points. But risk mitigation could be the solution you've been looking for.

Increase Driver Recruits by Effectively Managing Job Risks

Recruiting drivers has been a challenge for fleets due to the risks involved in driving heavy-duty trucks and equipment. There were 168,320 truck accidents in 2022, with 4,766 of these accidents being fatal for one or more persons involved.

To enhance recruitment and create a stronger safety culture, fleets are leveraging telematics and advanced driver data analytics, and they're investing in trucks with new safety features. They're not stopping there, though. They're telling job seekers all about them.

By emphasizing your company's safety initiatives and investments in your driver job ads, you're showing prospective employees how highly you prioritize your drivers' safety on the job. Drivers want to work for companies who care about them.

While driver training, pay, benefits, and other factors play a role in which career path they take, promoting your culture of safety is a positive step toward recruiting (and keeping) more drivers.

Reduce Insurance Premiums with Proactive Risk Mitigation Strategies

The rising risks associated with trucking not only impact driver safety but also affect your bottom line.

While large truck crashes slightly declined from 2022 to 2023, insurance industry experts anticipate higher commercial auto liability premiums due to rising costs and the continued presence of nuclear verdicts across the industry. According to the Insurance Information Institute (III), the culmination of social inflation and nuclear verdicts has led to a $30 billion surge in commercial auto claim costs since 2012.

However, transportation company owners and Fleet Managers are actively fielding these financial headwinds by adopting new safety technologies. For example, forward-facing event-recording cameras provide increased visibility, tracking, and analytics, enabling private fleets to challenge accidents on their record that are not their fault.

Especially with the CVSA Roadcheck 2024 coming up in just a few months, now is the time to diligently supervise your drivers' habits on the road.

MVR monitoring programs also notify Safety Managers of new traffic violations, such as speeding tickets, DWIs, and crashes, reported to their drivers' records.

Insurance underwriters consider these proactive safety measures when calculating commercial insurance premiums. If your company can prove it has invested and enrolled drivers in either of the above risk mitigation programs, you'll likely see a decrease in your commercial auto insurance costs.

Prepare for FMCSA Compliance Audits Before You're Caught Off-Guard

As we've previously discussed on the blog, "random" roadside inspections and DOT audits aren't random after all. Companies with higher risk profiles and histories of violations, crashes, and failed inspections are prioritized by the FMCSA.

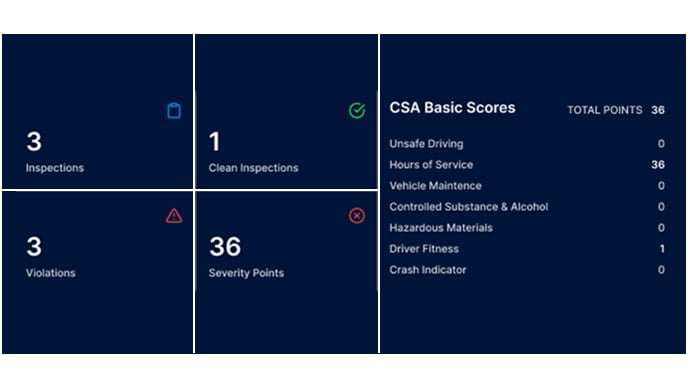

Monitoring your Compliance, Safety, and Accountability (CSA) score can help you avoid receiving the dreaded DOT audit letter. Since your CSA score is calculated from seven Behavior Analysis and Safety Improvement Categories (BASICs), it's important to know where your company stands within each of them.

A CSA Monitor program provides daily score updates, giving you a breakdown of crash, inspection, and violation reports for each driver. It allows you to see where your business is excelling in safety and identifies areas that may require attention. With a comprehensive report, you'll be informed about any changes to your CSA score, the safety events that caused these changes, and guidance on how to improve your compliance performance

Establish a Solid Risk Mitigation Partnership

Leveraging the latest technology and analytics in risk management allows for effective recruiting, post-hire monitoring, predictive analytics, and early DOT audit warning indicators. By implementing an event-based scoring system and considering collision history, fleets can better manage and reduce risks associated with driver behavior.

The time to build a better safety culture is now. Work with Foley and see the difference our data monitoring programs can make with your growing fleet. Get a free demo of our exclusive risk mitigation software or fill out the form below to get started.

Related Articles

Foley and Keystone Join Forces to Relieve Hard Commercial Insurance Market

What the Hardening Commercial Insurance Market Means for Trucking Companies

97% of Accidents are Preventable

.png)