ATRI Report Details Increases in Commercial Insurance Premiums

Purchasing commercial insurance has never been the most affordable investment for motor carriers, even if they purchase only the federal minimum of $750,000 in coverage. The well-known spike in insurance premiums has only made it more difficult for carriers of all sizes to afford and maintain the required amount of protection while running a successful (and profitable) business.

The American Transportation Research Institute (ATRI) Research Advisory Committee (RAC) prioritized the topic in their research in 2020, and their report The Impact of Rising Insurance Costs on the Trucking Industry was published last month.

The report provides a high-level look into the current situation surrounding commercial auto liability insurance in the trucking industry, the effects of increased insurance costs on carriers, and how trucking companies can help alleviate the soaring costs. Detailed data from over 80 carriers collectively operating nearly 95,000 commercial trucks backed the findings of the report.

In addition to the results of their research, ATRI’s annual An Analysis of the Operational Costs of Trucking report found that insurance premium costs per mile increased overall by 47 percent over the last ten years, from $0.059 to $0.087.

What’s Causing Insurance Premiums to Skyrocket?

According to the report, the cost increases can be traced back to three main causes:

- Economic conditions

- Social inflation

- Carrier-specific factors

If a carrier is literally paying the price for numerous violations, accidents, or lawsuits through their insurance premiums already, these aspects can only make matters worse. The days of incurring short-term costs for these unsafe operating practices are long gone; some companies are facing long-term consequences, including persistent rate spikes and even bankruptcy.

Economic Conditions

Healthcare and technology have undoubtedly advanced at impressive rates, but these progressions come at a high price. New medical treatments cost more and technological advances in vehicles are expensive to repair, regardless of the fact that they both save precious lives. The higher costs of these advances also cause increased insurance premiums when claims involve the use of one or both of these elements.

The struggle for insurance companies to remain profitable in the commercial auto industry over the past 10 years has also impacted the upward cost trend. Some insurance providers have even left the auto sector altogether. The result? Less competition for insurance companies and higher rates for consumers.

Social Inflation

A term many may not be very familiar with, “social inflation” is commonly used in the insurance industry to refer to general upticks in claims costs outside of economic inflation. ATRI describes social inflation as “the process of continuous change in public opinion relating to allocation of negligence, how much compensation is appropriate, or which parties ought to absorb costs of risk under particular circumstances.”

The social attitudes that take hold in the form of changes in laws, medical practices, claim and prosecution tendencies, and other matters directly impact insurance payouts. ATRI noted that if a claim goes to court, juries do not always come to their final conclusions based on logic or concrete examples, but are instead influenced by emotions, state and local laws or procedures, and plaintiff bar tactics.

In order to compensate for this frequently misled or uninformed placement of public opinion, insurance companies will often raise rates. It’s easy to see how this is becoming a problem with the recent rise in nuclear verdicts – exceptionally high jury awards that exceed historically rational amounts – in the trucking industry.

Carrier-Specific Factors

A lot goes into determining your company’s insurance premiums. The sector in which you operate, the value of your cargo, the region in which you operate, the rate your company is growing, and the amount you prioritize your safety technologies and culture as a whole all play a part in your insurance provider’s cost estimation. Even in today’s unfavorable market, motor carriers that operate equipment with new safety features, utilize safe driver hiring and training practices, and improve their crash history can potentially lower their premium costs.

Putting safety first not only protects your drivers, but it also preserves your budget. ATRI’s report said it best: “Carriers that prioritize safety as intrinsic to all departments in the company have the greatest control over insurance costs.”

Indirect & Long-Term Savings

It’s no surprise that new safety technologies can help reduce accidents and improve premium costs in a roundabout way. The challenge carriers face is paying for these relatively expensive upgrades up front without seeing the fruits of their labor for years down the line, potentially.

The good news is, some of the most commonly adopted safety technologies of the last three years have had the best impact on insurance premiums, including forward collision warning, adaptive cruise control, and lane warning systems – all of which are aimed toward reducing preventable crashes.

As noted in the ATRI report, insurance industry experts conveyed that a carrier’s pursuit of safety technology in general was more important than implementing any specific type of technology. In their eyes, an investment in safety technology in general demonstrates that a company recognizes and proactively prioritizes the importance of reducing accidents.

Yet Another Reason to Be Safe & Compliant

Bottom line, being a safe motor carrier means saving your bottom line.

“Carriers demonstrating consistent year-over-year improvements in safety technology adoption, safe driver hiring and training practices, and crash history can potentially lower their premium costs despite the current adverse environment,” ATRI emphasized.

In light of the state of the insurance market, we recently covered specific steps you can take to improve your risk profile and the likelihood of getting a better rate.

Read: What the Hardening Insurance Market Means for You and Your Business

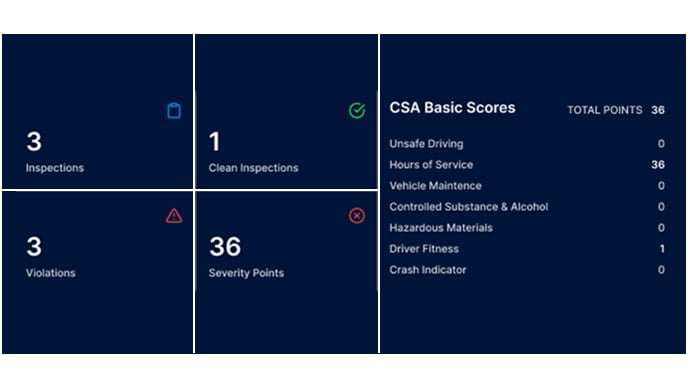

When you partner with a screening and compliance company like Foley, you can implement autonomous safety management software that keeps track of your fleet’s driving habits, documentation required for compliance, and any violations that may occur. Now is the time to put your drivers – and your wallet – first by investing in a better safety operations strategy.

Related Articles

Technical Issues Could Plague DOT Clearinghouse Yet Again

DOT Issues Statement on Use of CBD Products

Clearinghouse Query Plans Now Available

.png)