Retaining Drivers is More Important Than Ever—Here’s What They Care About

It’s no secret that there’s a driver shortage—the trucking industry has been dealing with it for years.

And Post-COVID, the shortage is worse than ever: The American Trucking Associations (ATA) estimates the current driver shortage at 63,000, and warns that that number could nearly triple in the next five years.

This is due to numerous factors: Many drivers have simply retired or left the industry because of the Drug & Alcohol Clearinghouse or due to COVID-related health concerns. The pandemic also meant the shuttering of many training schools and state department of motor vehicle locations for months on end, so the infusion of new drivers into the industry has all but stalled.

To recruit—and more importantly, keep—good drivers, carriers must understand driver needs and provide the benefits and culture they’re looking for. Those in the industry also recognize the importance of making systemic changes to reverse the dramatic numbers.

Differing Perspectives

Once again, the lack of drivers has been identified as the number one issue in the industry, according to The American Transportation Research Institute’s (ATRI’s) annual survey. The Institute’s large-scale report—whose respondents include motor carriers, commercial drivers and other industry stakeholders—also identifies driver compensation and driver retention among trucking’s top 10 issues.

However, as the ATRI points out, top-ranked issues for commercial drivers and motor carriers differ widely. For commercial drivers, company drivers, and owner-operators/independent contractors, driver compensation and truck parking were the top two concerns—whereas for motor carriers, the main concerns were driver shortage and driver retention.

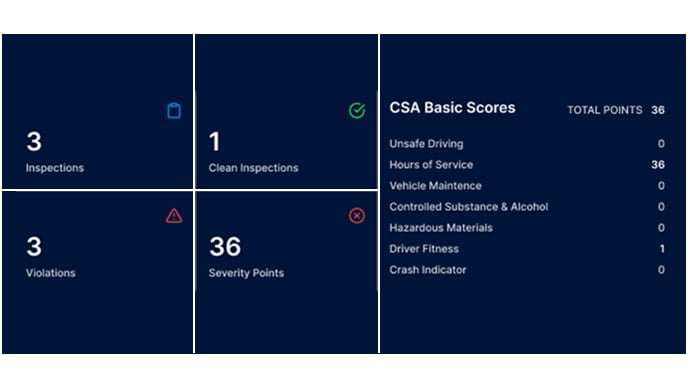

Other highly ranked driver concerns include detention/delay at customer facilities, hours-of-service (HOS), training standards, automated truck technology, the Compliance, Safety, Accountability (CSA) program, driver health and wellness, speed limiters, and the ELD mandate.

Other top-ranked carrier concerns, by contrast, centered around insurance cost/availability, Tort reform, the economy, transportation/infrastructure/congestion/funding and driver distraction. Carriers did share a top concern with drivers about the CSA and hours of service.

What Do Drivers Want?

As the above would suggest, carriers should carefully consider the issues that pop up on the ATRI’s list of top driver issues each year so that they can make them a priority in their business.

Not surprisingly, many drivers link the shortage largely to compensation. According to the ATA’s latest Driver Compensation analysis, the average annual pay for a national truckload solo van driver was $58,000 in 2019.

Raising pay and offering sign-on bonuses are clearly good first steps, but research also shows that drivers are looking for a positive workplace culture and an employer that cares about their wellbeing. Some carriers have started health and wellness programs focused on improving drivers’ quality of life on the road and at home. Speaking of which, many drivers are looking for a company that provides them more home time so they can improve their work-life balance.

Other factors to consider: Offering quality health insurance, life insurance, and retirement plans and paid holidays and leave time. Carriers are also exploring new and expanded pay models—whether those be salaried, hourly, per-load or percentage-of-load.

It might also be beneficial to financially incentivize drivers for safety, fuel economy and trip productivity performance. In a 2019 study by the ATRI, respondent fleets said they gave out average annual safety bonuses of $1,238.

Most importantly, listen to your drivers and appreciate and incorporate their feedback. After all, they’re the ones who know best about their needs, wants, and goals.

Proposed Solutions

Considering an overall aging workforce—27% of truckers are 55 or older—the majority of ATRI survey respondents called for getting younger drivers behind the wheel faster by making it possible for those age 18-20 to operate commercial motor vehicles in interstate commerce. As in the past, the report proposed the creation of an apprenticeship program to attract, train and retain younger drivers. This aligns with the DRIVE-Safe Act, which provides a framework for an apprenticeship program including hours of training, technology use and performance benchmarks.

Because drivers listed hours of service as a top concern, respondents also proposed quantifying the relationship between safety technology deployment—cameras, speed limiters, active braking systems—and driver satisfaction and retention.

Other proposals included expanding recruitment of female and minority drivers—which respectively represent 6.7% and 41.5% of the workforce—analyzing truck driver compensation in relation to competing employment sectors (such as construction), and researching and assessing new and expanded pay models and the effectiveness of financially incentivizing drivers for performance.

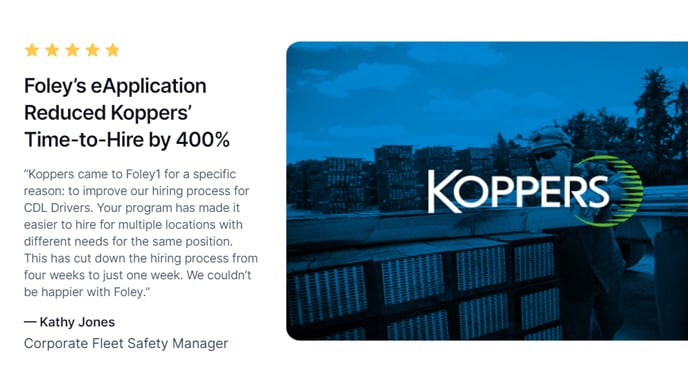

Need help recruiting and onboarding drivers? Have general compliance questions and concerns? Contact Foley today!

Related Articles

How the Drive Safe Act Aims to Curb the Driver Shortage

How to Build a Driver Retention Program That's Rock Solid

Worsening Driver Shortage is Carriers’ Top Issue of 2021

.png)