What are the Average Maintenance Costs and Expenses for a Semi-Truck Owner-Operator?

Price tags aren't one-size-fits-all, so we can't tell you exactly what you'll be paying. Your maintenance costs and expenses will depend on factors specific to your trucking business, like where you typically haul loads, whether you lease or own your rig, and if you comply with DOT regulations (non-compliance can result in costly violations).

However, we can outline various expenses you should be aware of and some average costs. Your mileage may vary (no pun intended!). For insurance and tax expenses, consult your accountant and insurance agent. The info below is meant to be educational, not legal advice.

Here's the list of maintenance costs and expenses that owner-operators must remember as they plan for the weeks, months, and years ahead.

- Fuel expenses + tolls

- Semi-truck maintenance and repairs

- Annual licensing, permits, and documentation

- Insurance expenses

- Cost of finding loads

- Other variable expenses

- Taxes, taxes, and more taxes!

- Unplanned expenses or unexpected downtime

Fuel Expenses & Tolls

By far, fuel is the biggest expense for owner-operators. The average semi-truck requires around 20,500 gallons of diesel a year. That can end up costing $70,000 (or more) per rig.

And let's not forget fuel taxes. Some owner-operators must file under the International Fuel Tax Agreement (IFTA). Foley provides answers to common fuel tax questions here.

Tolls are another cost if you use turnpikes as part of your regular hauls. Google has a great U.S. Toll Calculator. It also calculates fuel costs by vehicle type. Trucks are included as an option, and you can choose how many axles, from two to nine, allowing you to get granular in your calculations.

The good news with fuel costs: You can take specific measures to reduce them. The EPA offers a helpful guide with strategies you can use, from driver training to technologies that reduce idling to aerodynamic solutions (like truck fairings). The latter can reduce fuel use by as much as 3 to 15 percent.

Semi-Truck Maintenance & Repairs

With all the wear and tear rigs undergo as they make long hauls, repairs are to be expected, from hoses to brakes to alternators — to everything in between.

If you're a semi-truck owner-operator, you can expect annual maintenance and repair costs to weigh in at around $15,000. Plus, add another $4000 for tire replacements every year.

Keep in mind that preventive maintenance can save you money in the long run by spotting potential issues early before they become full-blown problems. The rule of thumb is to plan your maintenance per mile. This site offers a chart you can print and keep handy.

The FMCSA also has specific guidelines regarding the inspection, repair, and maintenance of CMVs.

And don't forget: The FMCSA requires CMV operators to keep vehicle maintenance files (for 12 months at least) and roadside inspection reports (from the previous 14 months).

Annual Licensing, Permits & Documentation

How big your rig is, where you operate, and endless other factors can influence the types of annual licensing, permits, and documentation you'll need as a semi-truck owner-operator.

Some common ones include:

- Business licenses

- Driver's license renewal fees

- US DOT registration

- Motor Carrier Operating Authority registration

- Unified Carrier Registration

- Vehicle inspections fees

- State transportation permit

- International Fuel Tax Agreement (IFTA) decal

- Heavy Vehicle Use Tax (HVUT)

Need more information on these documents? Watch our webinar, Intro to DOT Compliance: Required Permits & Registrations!

Insurance Expenses

After fuel, insurance expenses are one of the other big-ticket items that owner-operators need to consider.

What type of coverage you need will depend on how old you and your drivers are, how much experience you and your drivers have, your location, your claims history, and the age of your semi-trucks, among other things.

Working with a motor carrier might offer some coverage—the key is ensuring you don't have any gaps.

But it's your responsibility to carry adequate insurance to cover things like . . .

- Physical damage to your rig if it's involved in an accident

- Non-trucking liability insurance (this applies if you're not working for the motor carrier)

- Motor truck cargo coverage — this covers any goods that are damaged or stolen as you're hauling them

- Lease gap coverage — this covers you if your truck is totaled and the value of the rig is less than the amount you owe on the lease

And the above isn't an exhaustive list.

As for ballpark figures, this article from Insurance Hub says, "On average, it may cost $3,000 to $5,000 per year if you lease onto a motor carrier. However, if you operate under your own authority it may cost you around $9,000 to $12,000 per year. Unfortunately, if you're a new authority you could be paying close to $16,000 per year."

Remember that you might also need other types of insurance, such as health insurance (a common one if you're entirely independent) and disability insurance.

Shopping around for insurance can pay off — as can paying annually rather than monthly. (And it's worth revisiting policies every year.)

Cost of Finding Loads

You can't make money if you don't have loads to haul, right? Finding loads can feel like a full-time job sometimes, and an overwhelming one at that, given how many load job boards exist online.

Some are free, which can be an excellent place to start if money is tight. Others cost a fee but might produce more reliable results. Freight Waves highlights the best load boards for truckers, and the list includes both free and paid subscriptions. Freight Waves notes that paid subscriptions can be as much as $150/month, so you'll want to include that in your monthly expenses.

Other Variable Trucking Expenses

Your costs will fall into fixed and variable expenses. Fixed expenses are the costs you pay whether you drive your rig or not. Examples include truck payments, insurance, license fees, and permit costs. You must pay those bills, even if you haven't driven your rig in months.

Variable expenses, on the other hand, are the costs that you incur when you hit the road (and the money numbers behind these expenses can fluctuate, too—think fuel costs).

Common variable expenses for semi-truck owner-operators include:

- Food

- Fuel

- Lodging

- Maintenance

- Taxes

- Tires

- Tolls

Taxes for Semi-Truck Owner-Operators

Paying Uncle Sam is another cost that new owner-operators can overlook—or underestimate. Social Security and Medicare taxes are withheld from your paycheck each week when you're an employee for a trucking company. As a self-employed owner-operator, however, you're now on the hook for paying self-employment taxes. You also need to pay federal and state income taxes.

A very basic rule of thumb is to think in terms of thirds. A third of your revenue will cover business expenses (like insurance and maintenance costs), a third will go toward taxes, and a third will go to you.

Again, this is a simplified way of looking at your money numbers. Our point: Too many owner-operators either underestimate taxes, overlook them altogether, or fail to pay them quarterly (which can result in penalties).

The IRS has a good article on self-employment taxes, but you should consult an accountant about your situation. (You can usually deduct the accountant's fees as a business expense, so this is money well spent.)

Reminder: Taxes don't stop with the federal and state government. As we mentioned earlier, you might need to pay IFTA. Another one to have on your radar: The Heavy Vehicle Use Tax (HVUT), which currently starts at $100 per year and can go as high as $550 annually.

Unplanned Expenses or Unexpected Downtime

Not many people had a pandemic on their bingo card going into 2020. But by March, the world looked a lot different, with world economies coming to a screeching halt, followed by supply chain issues for months (and years).

Any new small business should have cash reserves set aside for the unexpected—and this is even truer for semi-truck owner-operators. This can be a hard pill to swallow, given how expensive it is to launch your own trucking business in the first place.

How much you need in reserves depends on your specific circumstances. Do you have a mortgage and a family you're taking care of? Or are you on your own and renting a small apartment? Does it make sense to invest in disability insurance in case you can't work?

A good insurance agent and accountant familiar with trucking and the semi-truck owner-operator business model can best guide you. But you'll need to factor these potential costs into your overall budget.

How Can You Make Your Trucking Business More Efficient?

As you can see, owner-operators have many more expenses than the average self-employed business owner — expenses that require meticulous recordkeeping.

Here are three strategies for making your trucking business more efficient.

1. Use a spreadsheet to track your profits, trucking expenses, and maintenance costs.

Using an online spreadsheet to track your profits, trucking expenses, and maintenance costs can be a great way to start. Check out this guide to vehicle maintenance recordkeeping.

2. Understand your average cost per mile.

Understanding the average cost per mile is the key to managing expenses and making smarter business decisions as an owner-operator.

To get your cost per mile, divide your total expenses for that month (fixed and variable) by the total miles driven that month.

Understanding your cost per mile helps you keep track of your business's profitability. For example, if your cost per mile for June was $1.36, and the rate per mile was $1.36, you're breaking even. If the rate per mile was $1.39, you're making a profit. If the rate per mile was $1.34, you're operating at a loss.

This is valuable intel. If you have an "off" month (or a couple in a row), you can take a hard look at expenses — and your approaches to them — to see if you can make adjustments that will help you become profitable (or more profitable).

But it all begins with keeping track of your operating expenses. Ignore this step at your own peril.

Many online resources and calculators exist, as does a lively Facebook Group called Rate Per Mile Masters, which boasts over 35,000 members. Working with an accountant can be incredibly helpful, too (along with software programs, like Rigbooks, to help track expenses).

3. Work with a partner who has experience guiding new owner-operators.

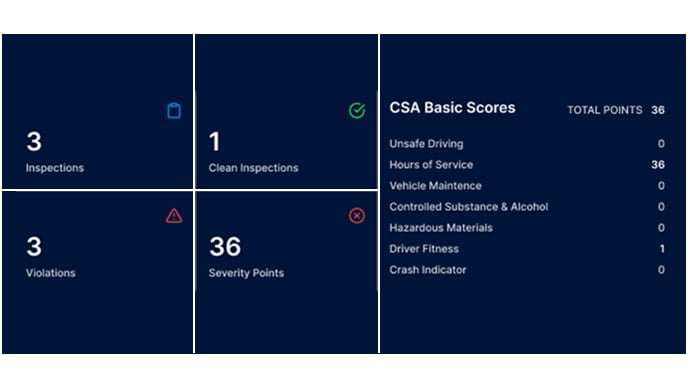

New owner-operators often fail in the first couple of years because they underestimate expenses and the importance of DOT compliance. It's virtually impossible to manage everything using paper files. Not to mention, when DOT auditors come knocking, they expect you to produce digitized records within a couple of days — or else.

We get that doing everything on your own might be a major source of pride. But here's the thing: You can't know what you don't know. Even though a ton of info exists online, some sources are more reliable than others (and it's not always easy to tell the difference).

So one of the smartest actions a new owner-operator can take is to work with a DOT compliance partner like Foley. We've worked with owner-operators for over three decades and understand what it takes to succeed in this business. Even better? We've designed a comprehensive, user-friendly software solution that helps trucking companies manage all compliance paperwork online from one intuitive dashboard.

The best way to experience how we help new entrants succeed is by scheduling a call with one of our consultants. They can review where you are today, alert you to DOT compliance gaps, and show you an easy way to manage everything online.

From all of us at Foley, we wish you safe travels and a thriving business!

.png)